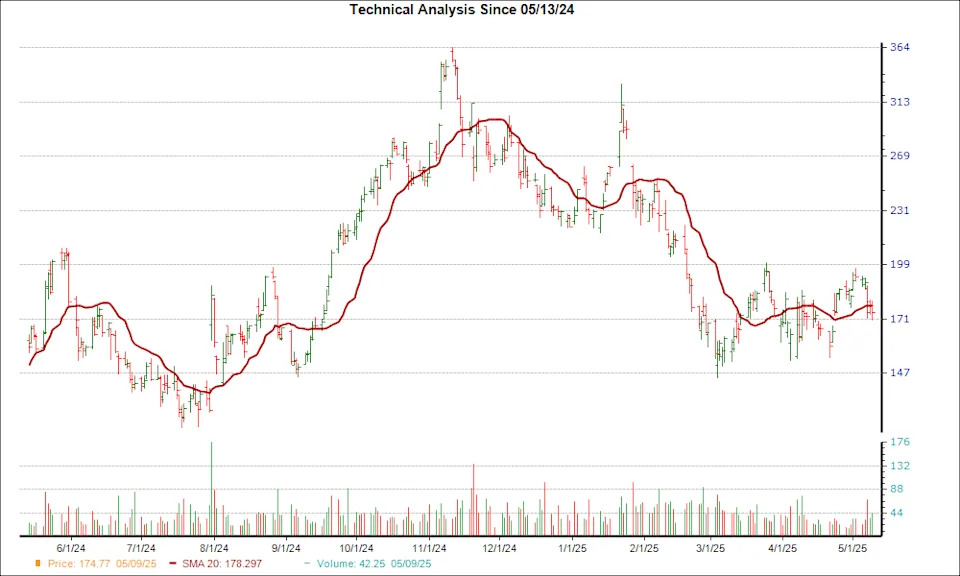

From a technical perspective, Powell Industries (POWL) is looking like an interesting pick, as it just reached a key level of support. POWL recently overtook the 20-day moving average, and this suggests a short-term bullish trend.

The 20-day simple moving average is a popular trading tool. It provides a look back at a stock's price over a 20-day period, and is beneficial to short-term traders since it smooths out price fluctuations and provides more trend reversal signals than longer-term moving averages.

Similar to other SMAs, if a stock's price moves above the 20-day, the trend is considered positive, while price falling below the moving average can signal a downward trend.

Shares of POWL have been moving higher over the past four weeks, up 9.3%. Plus, the company is currently a Zacks Rank #3 (Hold) stock, suggesting that POWL could be poised for a continued surge.

The bullish case only gets stronger once investors take into account POWL's positive earnings estimate revisions. There have been 2 revisions higher for the current fiscal year compared to none lower, and the consensus estimate has moved up as well.

Investors should think about putting POWL on their watchlist given the ultra-important technical indicator and positive move in earnings estimate revisions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Powell Industries, Inc. (POWL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research