Bitcoin soared to a record $109,767.52 on May 21, and as its market cap crossed the $2.16 trillion mark, it dethroned both Amazon and Alphabet to become the fifth-most valuable asset in the world.

This rally came as 10-year U.S. Treasury yields surged to 4.597%, last seen in 2023, testing global investors' appetite for risk.

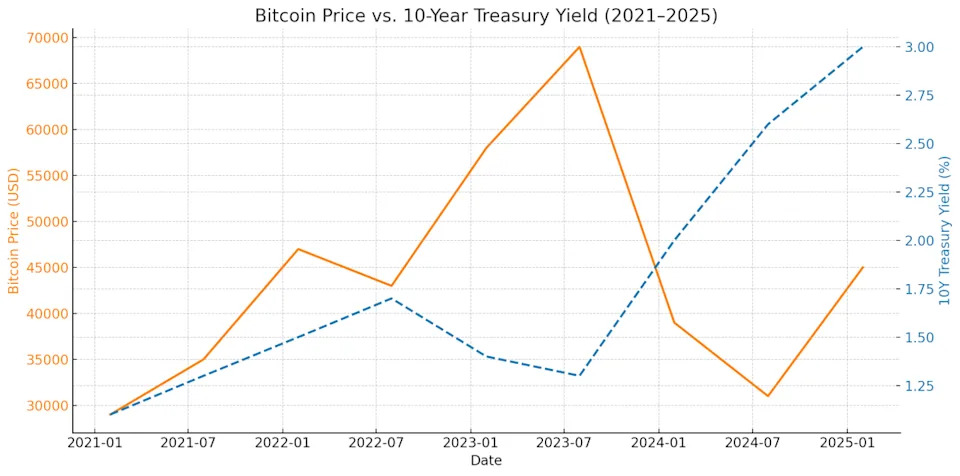

In the past, rising bond yields have diverted less capital to riskier assets such as Bitcoin, especially during periods of monetary tightening.

Prominent analyst Benjamin Cowen discussed in his podcast in early January that the rise in yield has occurred during a BTC bear market when other risky assets moved lower, such as in 2014, 2018, and 2022. These factors lead to higher borrowing costs for the government and have implications for various sectors of the economy, including mortgages and corporate financing.

From 2015 to 2025, while the market often amplified the macro narrative surrounding Bitcoin, its own narratives and market cycles occasionally took precedence. Consequently, correlations with bond yields can tighten and loosen depending on the environment.

Now in May 2025, that correlation is weaker than ever, with Bitcoin performing strongly at high yields. Bitcoin's move higher despite the multi-year high yield suggests that investors might be repositioning.

Bitcoin asset of choice in an uncertain world

Some analysts expect that investors are hedging against long-term inflation and a lack of fiscal stability. The U.S. is facing rising debt levels and considerable Treasury issuance, and while the 'real' return on bonds is at 5%, this may not seem safe to some.

Meanwhile, equity markets took a hit on May 21. The Dow fell 1.69%, the S&P 500 lost 1.16%, and the Small Cap 2000 fell 2.35%. The declines indicate investors are in 'flight' mode away from equities, accompanied by rising bond yields, etc.

This divergence begs the question of whether investors are instituting 'rotation' out of bonds and traditional equities into Bitcoin. Bitcoin is now the asset of choice in an uncertain, high-yield world.