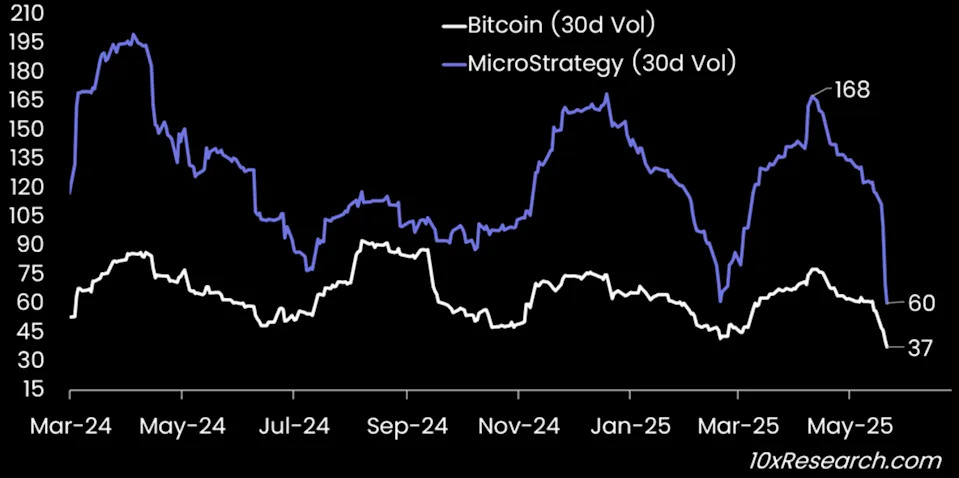

According to a new research from 10x Research, Bitcoin and MicroStrategy have entered a rare period of calm, with both assets exhibiting the lowest volatility in over a year.

Bitcoin's 30-day realized volatility has dropped to 37, while MicroStrategy's volatility has decreased to 60 from its high of 168 just a few weeks ago. MicroStrategy has now been rebranded as Strategy.

The market's coordinated reduction in price swings shows that it is settling. The sharp drop in volatility means price swings have cooled for retail investors, but it could be the calm before a significant move.

However, there are more signs of increasing institutional commitment under the surface. MicroStrategy recently raised $2 billion in zero-coupon convertible notes, which, according to reports , will be used solely for additional Bitcoin purchases.

The buy-side goes into overdrive as U.S. spot bitcoin ETFs surpass 1.2 million BTC in holdings with nearly $1 billion in net inflows through two months of trading sessions.

CoinMarketCap's new report also shows other more positive tailwinds: Russia established legal property status for Bitcoin for cross-border trade, and U.S. States such as Arizona, New Hampshire, and Texas now allow Bitcoin reserves .

However, analysts warn that this lower volatility could be a double-edged sword. It could peak either way for greater upside momentum or be a tenuous moment for macro risk-off.

Bitcoin and MicroStrategy aren't swinging like they used to first appeared on TheStreet on May 23, 2025