(Bloomberg) -- Goldman Sachs Group Inc. touted gold and oil as hedges against inflation in long-term portfolios, citing the appeal of bullion as a haven amid concerns over US institutional credibility and crude’s ability to protect against supply shocks.

Analysts including Daan Struyven said investors with so-called 60/40 portfolios — an investment strategy of allocating to equities and bonds — have historically been able to maintain average annual returns while reducing risk by adding long-term allocations of the two commodities.

“Following the recent failure of US bonds to protect against equity downside and the rapid rise in US borrowing costs, investors seek protection for equity-bond portfolios,” the analysts said in a note on Wednesday. “During any 12-month period when real returns were negative for both stocks and bonds, either oil or gold have delivered positive real returns.”

The analysts recommended a higher-than-usual allocation to bullion and a lower-than-usual — but still positive — weighting to crude, calling the commodities “critical” hedges against inflation shocks that tend to hurt bond and equity portfolios.

The popular 60/40 approach has been challenged in recent years as its underlying mechanism broke down, with US stocks and bonds moving in lockstep rather than offsetting each other. The strategy has seen fresh setbacks as long bonds have slumped in recent months, driven by investors’ growing reluctance to hold long-term US sovereign securities amid spiraling debt and deficits.

That wariness underscores the potential risk that markets could lose faith in the credibility of US institutions. Such a scenario — which would likely boost bullion’s allure as a haven asset — could trigger a sustained selloff in both US bonds and equities, according to Goldman.

The analysts, citing historical data, said 60/40 portfolio holders targeting an average annual return of 8.7% have been able to reduce risk from about 10% to just under 7% through adding gold and oil.

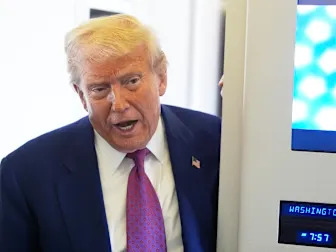

Meanwhile, US President Donald Trump’s contentious relationship with the Federal Reserve has also added to worries, following several comments indicating his desire to oust Chair Jerome Powell from his position. Reduced central bank independence has historically led to higher inflation, they added, again pointing to bullion as a hedge in a higher price environment.

If concerns about the US fiscal position and Fed independence intensify, a flight into gold by private investors could drive prices well beyond the bank’s current forecast of $3,700 an ounce by year-end and $4,000 an ounce by mid-2026.

Given the bullion market is small relative to other major asset classes, “even a small diversification step out of US fixed income or risk assets could cause the next giant leap for gold prices,” the analysts said. Robust central bank purchases for at least another three years should also underpin the metal’s strength, they added.

Oil is also a positive for Goldman, with energy disruptions difficult to predict and a likely sharp slowdown in non-OPEC supply growth from 2028 raising the chance of a supply shock. Still, high spare capacity limits the upside for now, the analysts said.