Information

- Jan 17, 2025

Why Is Versus Systems Stock Rocketing Today?

Versus Systems Inc. (NASDAQ:VS) shares are trading higher premarket on Friday. On Thursday, the company expanded into Brazil to strengthen its international presence. Also, the company plans to enhance its gamification platform’s impact on audience engagement across industries. Versus Systems has appointed Flavio Maria as the Country Manager for Brazil, one of the largest global gaming markets with over 100 million users. Luis Goldner, Chief Executive Officer of Versus Systems said, “We’re thril

- Jan 17, 2025

Welsh Carson agrees to pare back anesthesia market power to avoid new FTC suit

Antitrust regulators have reached a deal with Welsh, Carson, Anderson and Stowe that doesn’t penalize the private equity firm for rolling up the market for anesthesia services in Texas, but tries to prevent it from happening again.

- Jan 17, 2025

Crypto Venture Capital Market Remained Difficult in 2024, Galaxy Digital Says

VC activity has been subdued for the last two years despite the rally in digital assets, the report said.

- Jan 17, 2025

iCapital buys Parallel Markets to enhance investment onboarding

iCapital's Investor Passport aims to streamline compliance and onboarding, saving time and costs in private markets.

- Jan 17, 2025

Analysis-Markets are betting China will let yuan fall as Trump takes power, but not much

Financial markets are betting China will not use the yuan as a policy tool to offset expected U.S. tariffs in a second Donald Trump presidency, based on a view that sharp depreciation like that seen in his first term will be more harmful than helpful to the struggling economy. From the pricing of yuan forwards to interest rate derivatives and analysts' forecasts, indications are that China is already permitting a slow depreciation of the yuan to adjust to a broadly stronger dollar as it braces for Trump 2.0. But pricing also shows investors are expecting a gradual, moderate depreciation, with sell-side analysts seeing a 5-6% drop from current levels by year end.

- Jan 17, 2025

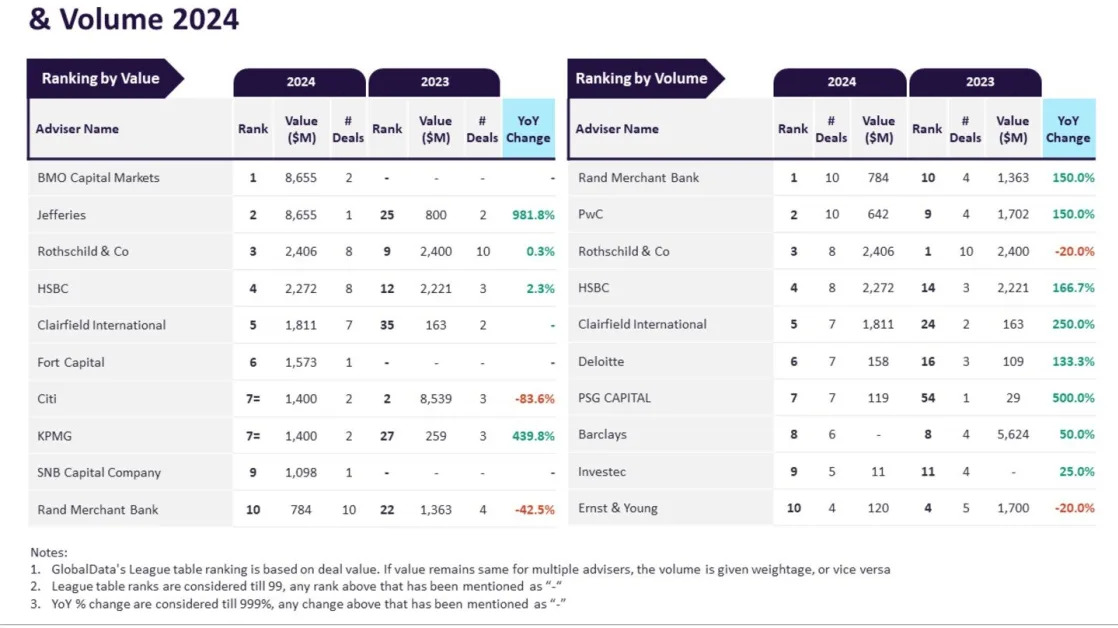

BMO Capital Markets, Rand Merchant Bank lead MEA M&A advisory in financial services for 2024

Capital Markets secured the top position by value, advising on deals worth a total of $8.7bn.

- Jan 17, 2025

Pro-Crypto Playbook by DJT Sparks Bitcoin Moves, State Reserves, and a Dazzling DC Gala

This week, a series of bold moves, from states pushing for official crypto reserves to high-stakes Senate battles over document integrity, signal a seismic shift in US crypto policy. All eyes are now on Trump’s audacious plan for a government bitcoin stockpile, a move celebrated at a star-studded DC gala and debated as potentially transformative for the nation’s financial future.

- Jan 17, 2025

Fed to hold rates in Jan as Trump's policies stir inflation worries: Reuters poll

The U.S. Federal Reserve will hold interest rates steady on Jan. 29 and resume cutting in March, according to a slim majority of economists polled by Reuters, as policymakers digest an expected barrage of new economic policies from Washington. The latest survey, taken in the week before U.S. President-elect Donald Trump's inauguration on Jan. 20, also suggests lingering inflation pressures may only allow the Fed to cut rates once more. Concerns around Trump's pledges, ranging from across-the-board tariffs, extending tax cuts, to deportations of illegal immigrants, have already contributed to a dramatic rise in U.S. Treasury yields before he takes office.

- Jan 17, 2025

The Trump Economy Begins: 4 Money Moves Retirees Should Make Before Inauguration Day

A change in presidential economic policy generates curiosity and concern about the direction and flow of interest rates or which economic sectors could flourish under the upcoming administration....