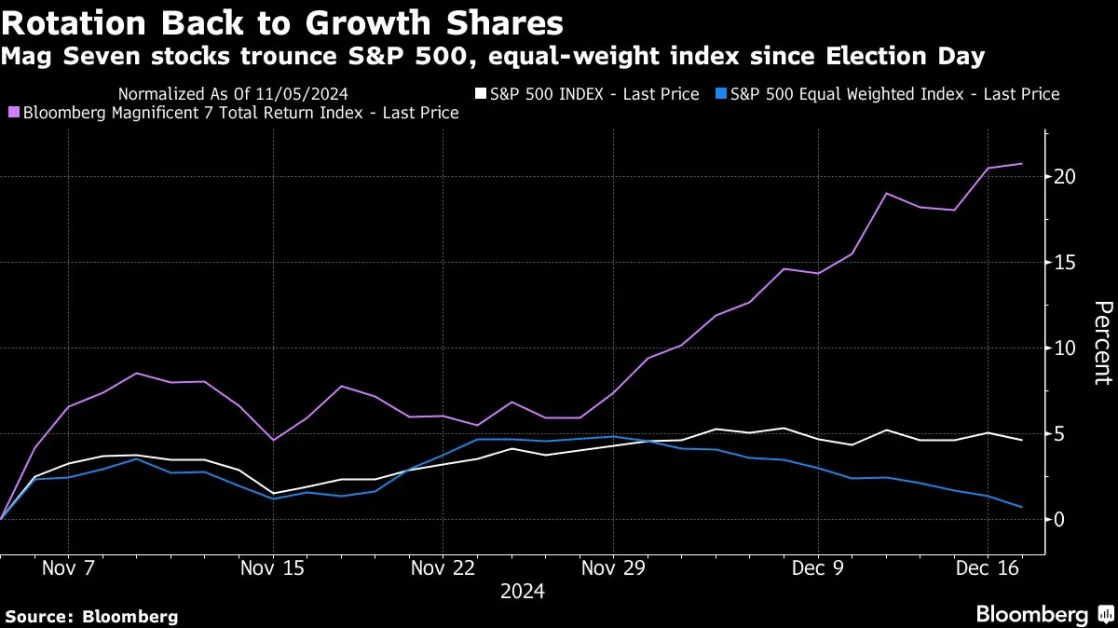

Fed looks set to tweak reverse repo rate to speed exit of cash

The Federal Reserve appears likely to take a step on Wednesday to nudge cash off its balance sheet as it enters a more uncertain period in what many see as the final months in its effort to draw down its balance sheet. Economists broadly expect the Fed to announce it's cutting the rate it pays money market funds and others to park cash at its overnight reverse repo facility, or ONRRP, by a bigger margin than the expected cut to its policy rate. While the federal funds rate target is seen being trimmed by a quarter-percentage-point to between 4.25% and 4.50%, the reverse repo rate, or RRP, is seen falling to 4.25% from its current setting of 4.55%.