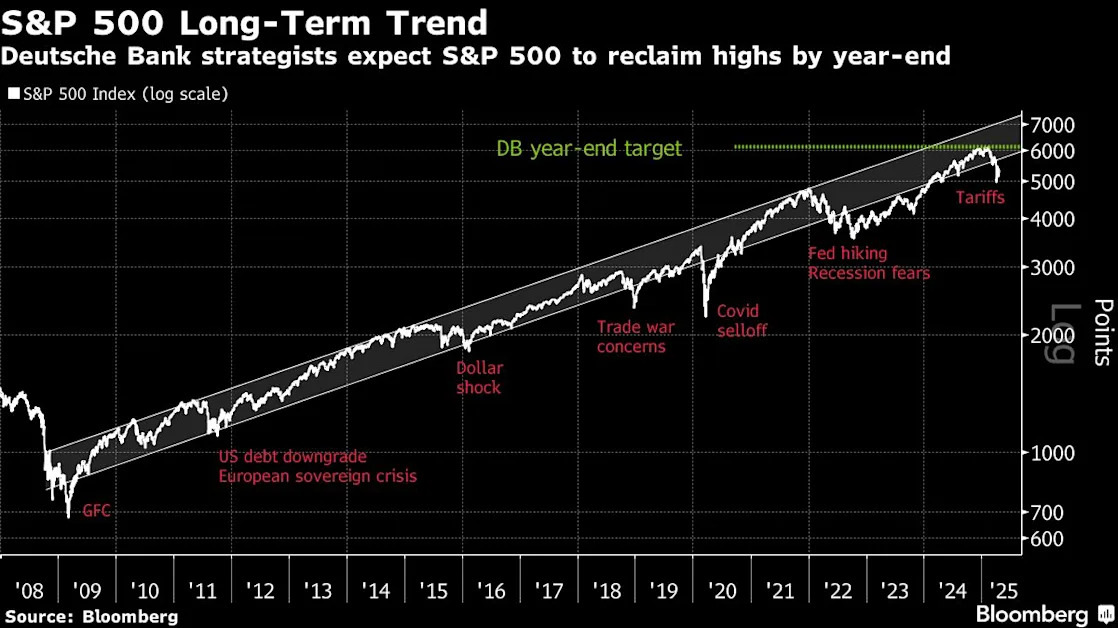

Analysts game out use of Fed toolkit if market needs central bank's help

NEW YORK (Reuters) -Market participants unsettled by the Trump administration's choppy policy rollout are working to game out what the Federal Reserve would do if asset prices spiral out of control and require stabilization by the U.S. central bank. The anxiety arises from weeks of volatile trading and big price declines across a range of securities due to President Donald Trump's seesawing tariffs announcements, which are widely expected to stoke inflation while depressing growth and hiring. A more recent wave of price swings followed on the heels of Trump's attacks on the Fed for not cutting interest rates since he returned to power in January and his public musings about firing Fed Chair Jerome Powell.