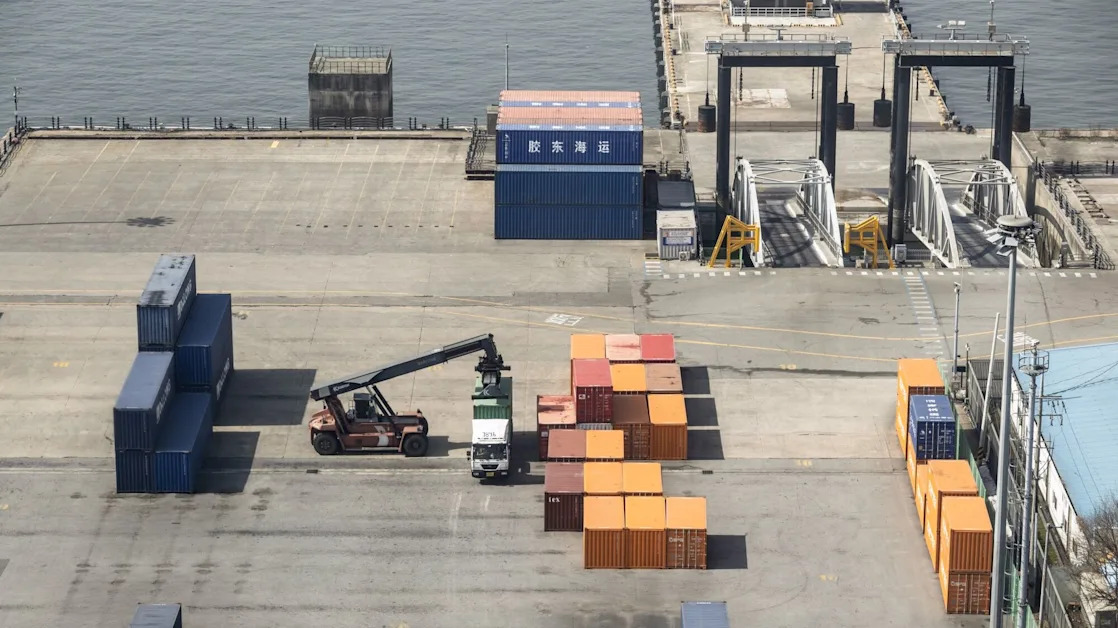

US, South Korea Set for Trade Negotiation as Tariffs Hit Economy

(Bloomberg) -- Supply Lines is a daily newsletter that tracks global trade. Sign up here.Most Read from BloombergDOGE Visits National Gallery of Art to Discuss Museum’s Legal StatusTrump Administration Takes Over New York Penn Station RevampDOGE Places Entire Staff of Federal Homelessness Agency on LeaveNashville’s $3 Billion Transit Plan Brings a Call for Zoning ReformSouth Korea and the US will kick off trade negotiations this week as the Asian export powerhouse seeks to persuade Donald Trump’