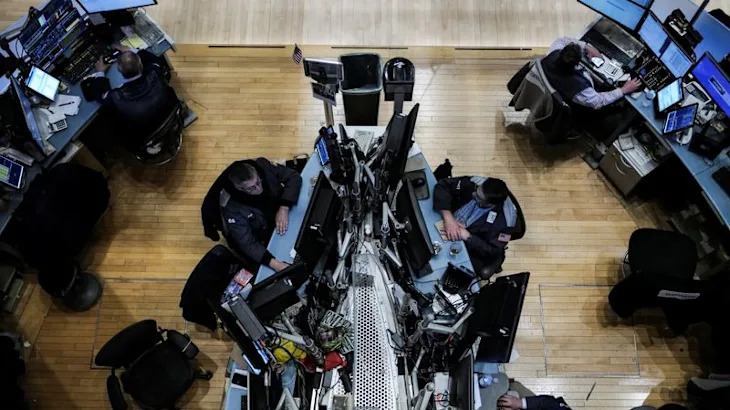

Tariff-Fueled Market Rout Cost Chicago’s Pensions $1 Billion

(Bloomberg) -- Four Chicago pension funds are estimated to have lost nearly $1 billion amid the market rout set off by President Donald Trump’s tariff policies, a blow to the city’s retirement programs that are among the least funded of all major US cities.Most Read from BloombergHow Did This Suburb Figure Out Mass Transit?The Secret Formula for Faster TrainsEven Oslo Has an Air Quality ProblemNYC Tourist Helicopter Crashes in Hudson River, Killing SixLisbon Mayor Wants Companies to Help Fix Cit