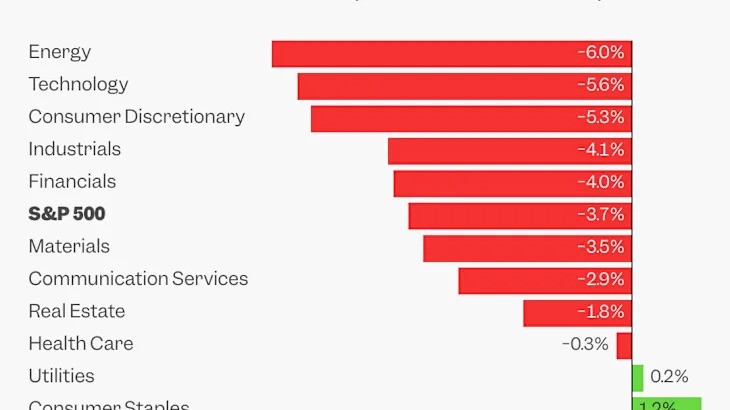

Trump says things are 'going very well' after worst stock market drop in years over tariffs

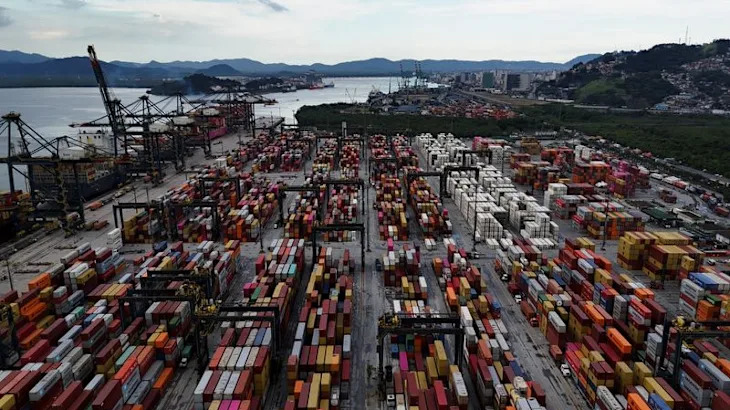

President Donald Trump offered a rosy assessment after the stock market dropped sharply Thursday over his tariffs, saying, “I think it's going very well.” “The markets are going to boom, the stock is going to boom, the country is going to boom,” he said when asked about the market as he left the White House to fly to one of his Florida golf clubs. The Dow Jones Industrial Average dropped more than 1,600 points on Thursday as U.S. stocks led a worldwide selloff after the Republican president's announcement of tariffs against much of the world ignited a shock like none seen since the COVID-19 pandemic.