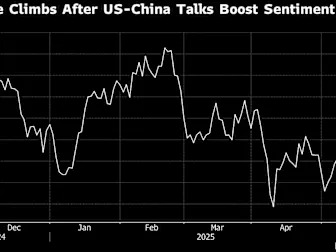

Oil Holds Four-Day Gain Spurred by Trade Optimism, Iran Remarks

(Bloomberg) -- Oil held the bulk of its biggest four-day rally since October, spurred by the US-China trade détente and President Donald Trump’s increasingly hostile rhetoric on Iranian supply, Most Read from BloombergAs Coastline Erodes, One California City Considers ‘Retreat Now’A New Central Park Amenity, Tailored to Its East Harlem NeighborsWhat’s Behind the Rise in Serious Injuries on New York City’s Streets?How Finland Is Harvesting Waste Heat From Data CentersLawsuit Challenges Trump Admi